maryland ev tax credit 2022

Up to 26 million allocated for each fiscal year 2021 2022 2023. Staff will confirm receipt of electronic applications within one to two business days via email.

When possible please submit applications electronically to avoid mail delays.

. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in Hybrid. Federal Income Tax Credit A federal tax credit is available to buyers of new plug-in electric vehicles based on battery capacity and ranges. Rules and Executive Nominations A BILL ENTITLED 1 AN ACT concerning 2 Clean Cars Act of 2022 3 FOR the purpose of extending and altering for certain fiscal years the vehicle excise tax 4 credit for the purchase of certain electric vehicles.

When possible please submit applications electronically to avoid mail delays. Would apply to new vehicles purchased on or after July 1 2017 but before July 1 2023. For Maryland residents who purchase a new EV or PHEV within state lines there are several incentives to take advantage of thanks to the Maryland Clean Cars Act of 2019 HB1246.

Between July 1 2021 and June 30 2022 the rebate may cover 40 of the costs of acquiring and installing qualified EVSE or up to the following amounts. Reducing the vehicle excise tax credit for certain. Maryland State Department of Assessments Taxation 2022 Renters Tax Credit Application RTC1 Form- Filing Deadline October 1 2022 Apply online wwwtaxcreditssdatmarylandgov INFORMATION The State of Maryland provides a direct check payment of up to 100000 a year for renters who paid rent in the State of Maryland and who meet.

Notable award recipients include Highland Electric Fleets and Swann Transportation who will purchase and deploy electric school buses on behalf of the Baltimore. It is scheduled to take effect July 1 and will apply to each tax year from 2022 to 2028. Subject to available funding a credit is allowed against the excise tax imposed for the purchase of a plug-in electric or fuel cell electric vehicle and the credit may not exceed the lesser of the amount of excise tax paid or 3000.

The rebate is up to 700 for. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

Commercial solar installations however can claim a credit up to 150000 depending on the size of the solar panel system. Extending and altering for certain fiscal years the vehicle excise tax credit for the purchase of certain electric vehicles. In Tax Year 2021 MEA issued 164 residential and commercial tax credits certificates for energy.

Other Maryland Solar Incentives. If you have mailed in your application we ask that you contact us via phone at 410-537-4000 or 1-800-72-ENERGY or email at DLInfo_MEAmarylandgov to confirm receipt. 5 2 in addition to the property tax credit provided under.

The state offers a one-time tax credit of 100 per kilowatt-hour of battery capacity up to a maximum of 3000. Residential Construction - Electric Vehicle Charging. Several months later it seems that revisions to the credit are returning to lawmaker agendas.

Larry Hogan flanked on his left by House Speaker Adrienne Jones D-Baltimore County and on his right by Senate President Bill Ferguson D-Baltimore signs into law a bill giving tax credits to single retirees earning 100000 or less and retired couples earning 150000 or less. For model year 2021 the credit for some vehicles are as follows. The Maryland Energy Administration MEA has opened the application period for the Tax Year 2022 TY 2022 Maryland Energy Storage Income Tax Credit Program.

Maryland offers a rebate of 40 of the cost of Electric Vehicle Charging Equipment and Installation. Maryland citizens and businesses that purchase or lease these vehicles. Decreasing from 63000 to 55000 for purposes of the electric vehicle excise tax credit the limitation on the maximum total purchase price of certain electric vehicles.

This means that pretty much all new EVs or PHEVs will. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the amount of the State income tax liability. 1500 tax credit for each plug-in hybrid electric vehicle purchased.

The Maryland Energy Administration MEA offers a rebate to individuals businesses or state or local government entities for the costs of acquiring and installing qualified EVSE. For forms visit the 2021 Individual Tax Forms pages. ZeroEmission Medium and Heavy Duty Vehicles Regulations ZeroEmission Truck Act of 2022 MD.

Whats New for the 2022 Tax Filing Season 2021 Tax Year Here are some of the most important changes and benefits affecting the approximately 35 million taxpayers working on their 2021 Maryland income tax returns. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. Funds were capped at 750000 in 2021.

Decreasing for purposes of the. If the credit is more than the state tax liability the unused credit may not be carried forward to any other tax year. The criteria for a qualifying plug-in electric or fuel cell electric vehicles are as follows.

President Bidens EV tax credit builds on top of the existing federal EV incentive. If you have mailed in your application we ask that you contact us via phone at 410-537-4000 or 1-800-72-ENERGY or email at DLInfo_MEAmarylandgov to confirm receipt. February 15 2022 Assigned to.

Transportation Electrification and Modernization TEAM Act. What Is the New Federal EV Tax Credit for 2022. This program is designed to encourage the deployment of energy storage systems in Maryland.

House bill 1039 5 1 b 1 the mayor and city ouncil of baltimore ity and the 2 governing body of each county and of each municipal corporation shall 3 grant a property tax credit under this section against the county or 4 municipal corporation property tax imposed on a qualified property. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned. The credit ranges from 2500 to 7500.

Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. Staff will confirm receipt of electronic applications within one to two business days via email. Clean Cars Act of 2022.

To create a cleaner and greener transportation sector the Maryland Energy Administration has awarded 19 million to fleet operators throughout the state for the first round of the 2022 Clean Fuels Incentive Program. 2021 Instruction Booklets for Individuals. 3000 tax credit for each plug-in or fuel cell electric vehicle purchased.

Funds for this Maryland solar tax credit are limited and available on a first-come first-served basis. 12 hours agoMaryland Republican Gov. Funding is currently depleted for this Fiscal Year.

Introduced and read first time. Updated March 2022. Larry Hogan flanked on his left by House Speaker Adrienne Jones D-Baltimore County and on his right by Senate President Bill Ferguson D-Baltimore signs into law a bill giving tax credits to single retirees earning 100000 or.

Epa Finalizes Tougher Vehicle Emission Standards Roll Call

2022 Toyota Tacoma Sr Silver Spring Md Rockville Frederick Baltimore Maryland 3tysx5enxnt012879

Mdenergy Twitter Search Twitter

2022 Lexus Ux 200 Base Silver Spring Md Rockville Frederick Baltimore Maryland Jthx3jbh8n2048371

Ev News Top 10 Most Electric Vehicle Friendly States Techrepublic

Vita Tax Prep Mondays Lifestyles Of Maryland La Plata Tickets Mon Apr 11 2022 At 9 30 Am Eventbrite

Mdenergy Twitter Search Twitter

Forbes Wheels Ev Tax Credit Calculator Koam

Updated Reconciliation Text Includes Electric Vehicle Tax Credit Opposed By Manchin The Hill

Pluginsites Page 7 Of 49 Ev Charging From A Driver S Perspective

Gas Tax Holiday These 17 States Are Working On Legislation To Ease Costs At The Pump

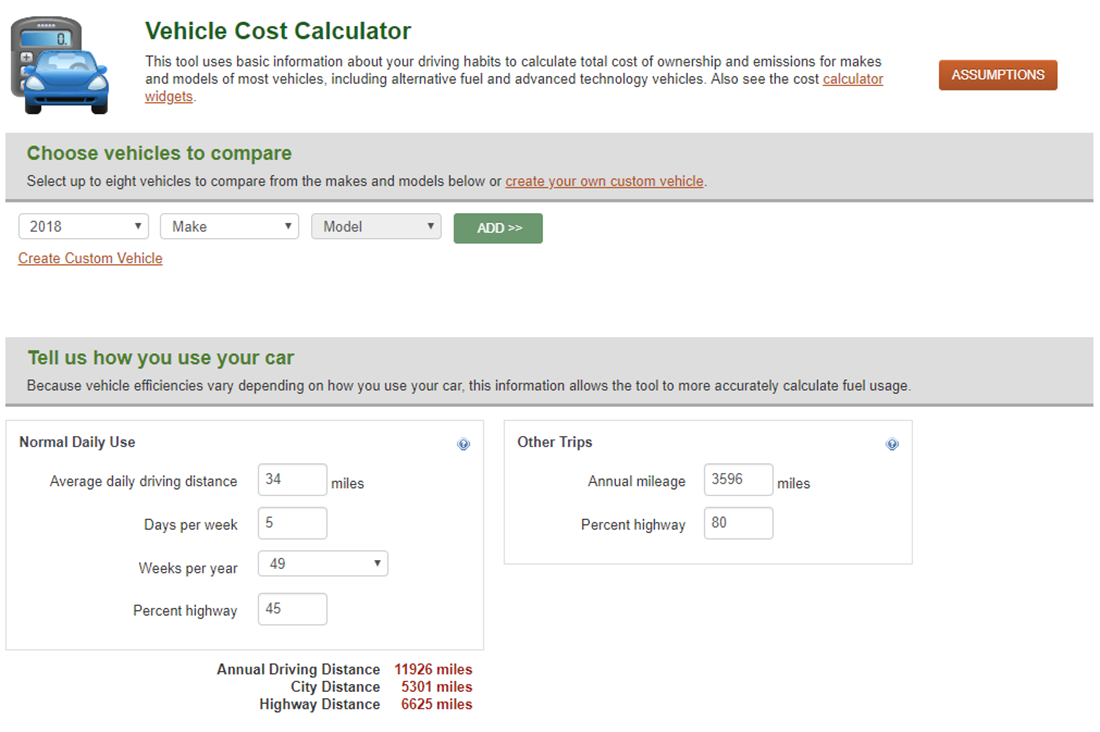

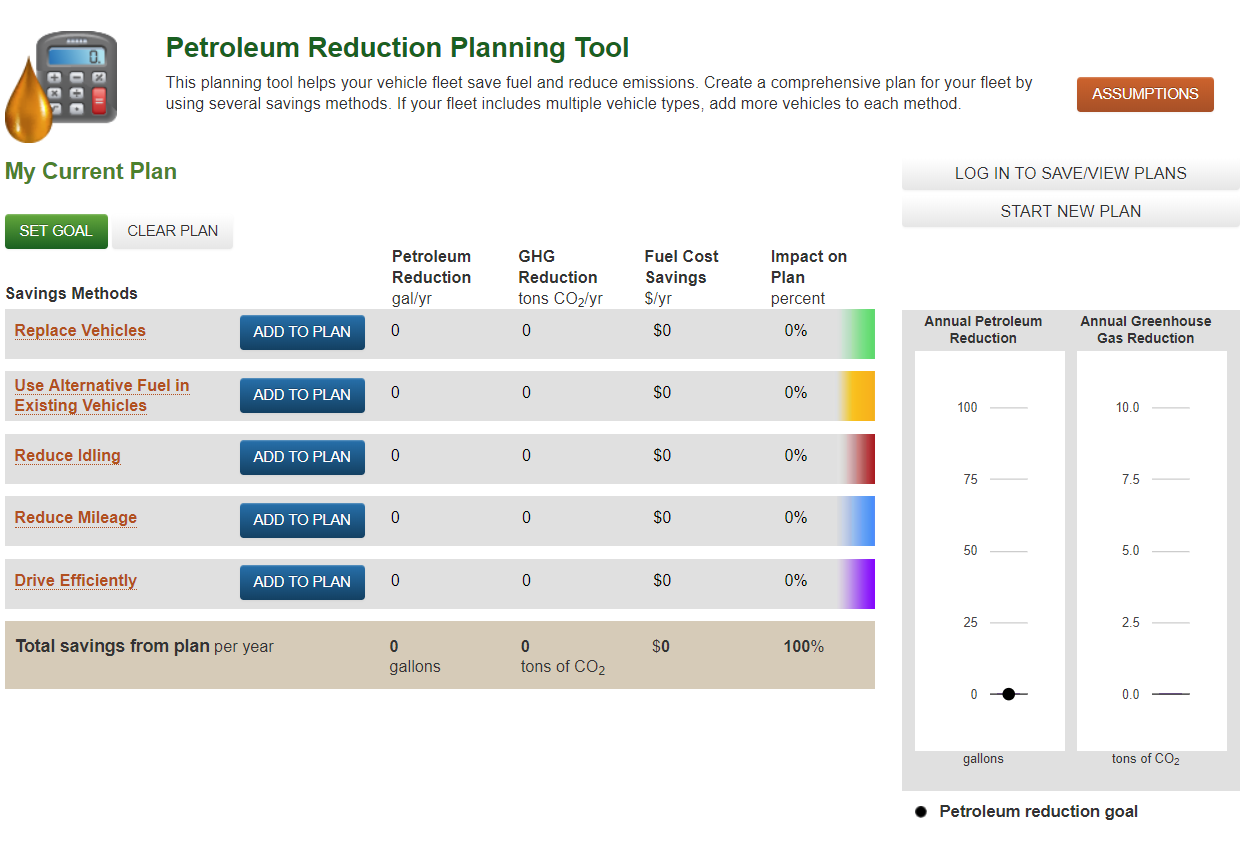

Maryland Energy Administration

Maryland Solar Incentives Md Solar Tax Credit Sunrun